Fact Sheet

Kyriba – The Global Leader in Cloud Treasury Solutions

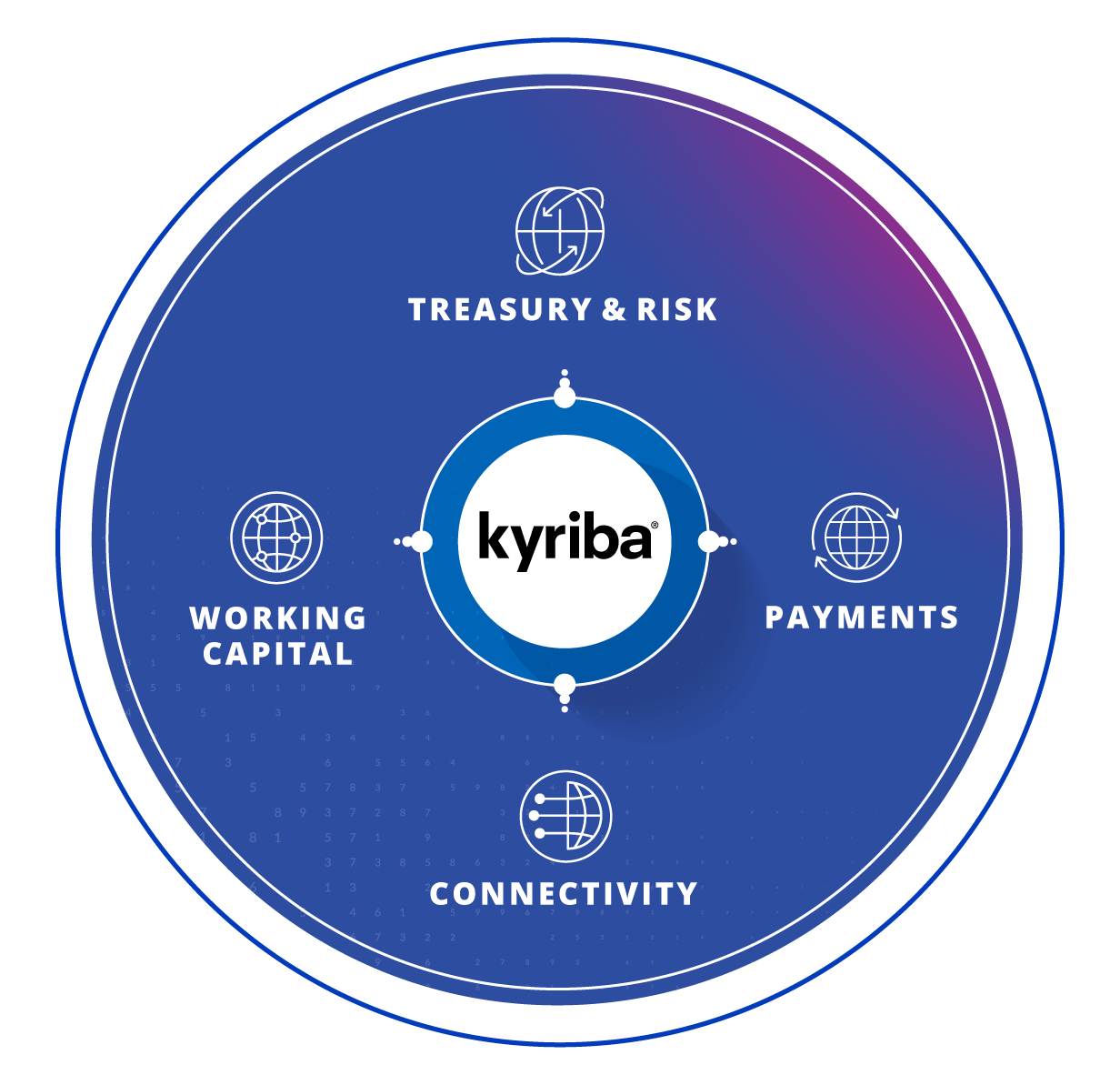

Kyriba’s Enterprise Liquidity Management Platform offers Treasury and Risk, Connectivity, Payments, and Working Capital solutions delivering visibility, controls, productivity and data-driven decision making for CFOs and their teams. Delivered through our open API platform, finance organizations gain access to new products and services coupled with enterprise-wide integration to and from banks, ERPs, third party systems, and internal data sets.

With Kyriba, CFOs can see, protect, grow, and move liquidity with unprecedented velocity, precision, and efficiency.

Kyriba combines these leading products to deliver a proven, holistic Enterprise Liquidity Management platform with open end-to-end connectivity across your systems and banking partners.

Kyriba provides CFOs and treasurers with the visibility and reporting they need to optimize cash returns, control bank accounts, drive reporting and compliance, and manage liquidity.

Treasury Management

Cash Management

Complete cash visibility with flexible cash position dashboards and full reconciliation capabilities makes it easy to view prior-day and intraday postings.

Cash Forecasting

Kyriba offers extensive options for modeling and measuring the effectiveness of forecasts, so clients can extend the accuracy and horizon of their cash forecasting.

Cash Pooling and In-house Banking

Clients can manage notional and physical cash pools to offer real-time intercompany positions, interest calculations and automated reporting.

Multilateral Netting

Multilateral netting calculates net payables and receivables positions by participant, optimizing exposure management and in-house bank integration.

Bank Relationship Management

Bank account management (BAM), signatory tracking, FBAR reporting and bank fee analysis provide improved control of bank accounts and more transparency into bank fees.

Treasury & Risk Management

Kyriba provides CFOs and treasurers with the visibility and reporting they need to optimize cash returns, control bank accounts, drive reporting and compliance, and manage liquidity.

Financial Transactions

Fully track treasury financial transactions for your investments, debt, and risk instruments with complete integration to the payments, accounting and cash forecasting modules.

Accounting and Compliance

Journal entries can be generated for all cash and liquidity models. With automated ERP integration with the general ledger, Kyriba delivers bankto- book reconciliation for monthly matching of bank actuals with uploaded accounting balances.