FAQ

What is a Payment Hub?

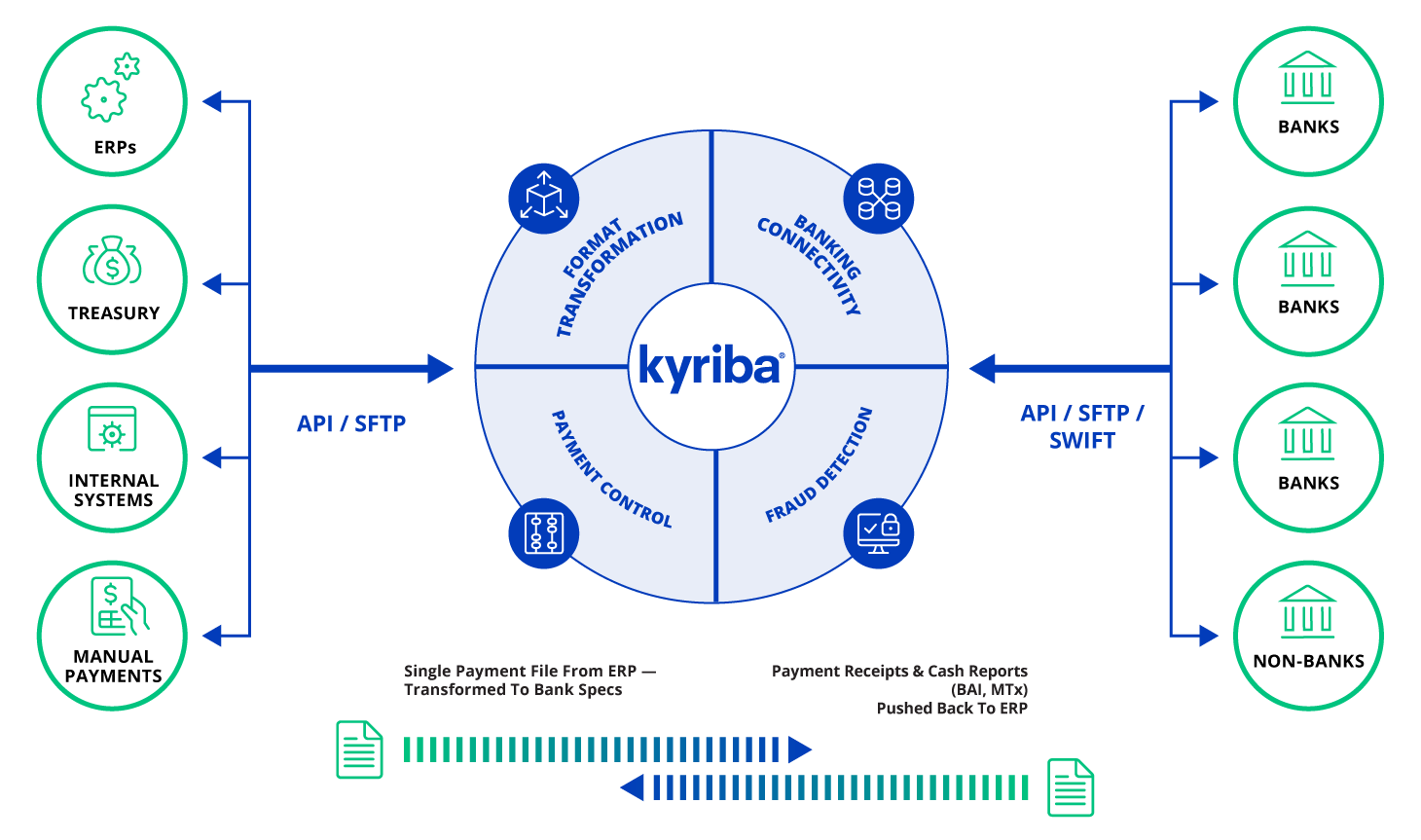

A payment hub is a centralized hub where all payment streams across an organization are consolidated and processed in a centralized manner.

The payment streams can come from different ERP or other payment initiating systems by teams such as Accounts Payable, Treasury, Finance and HR. The consolidated payment streams are then transformed into a single source of record for all outgoing payments and incoming payment confirmation, statements and transaction records.

A payment hub is also capable of converting payment data into bank-specific file formats and connecting directly with global banks through required connectivity options, such as host-to-host, API or SWIFT. In centralizing and standardizing corporate payments, payment hubs improve process efficiency, team productivity and reduce fraud risks.

Table of Contents

- What Are the Pain Points Without a Corporate Payment Hub?

- How Do Corporates Benefit from a Payment Hub?

- Key Features of a Payment Hub

- Difference Between a Payment Hub and an In-House Bank

- How to Select the Right Payment Hub Solution

- How to Implement a Payment Hub

- How to Manage Payment Approval Workflows with a Payment Hub

- ROI of Using a Payment Hub Solution

- Examples of Payments Hub Software

What Are the Pain Points Without a Corporate Payment Hub?

Processes for managing corporate payments are traditionally challenged by the sheer volume of payment activities and its manual processing inefficiency. Usually there are different teams who need to process payments and they are de-centrally located, causing communication and visibility challenges too.

In the absence of a payment system to manage the payment process across different teams, some of the most outstanding pain points are:

- Outdated back-office payment systems requiring extensive and costly IT support

- Long lead time to connect to banks via API or H2H with own IT resource

- Unavoidable payment errors and oversights from manual processing

- Potential money loss from undiscovered duplicate payments

- Increased operational risks due to potential fraud and non-compliant payments

- Slowness to leverage faster payment rails (e.g., RTP®) or other nascent payment methods (e.g., Zelle) to support customers’ evolving payments needs

How Do Corporates Benefit from a Payment Hub?

Payment hubs deliver a wide range of benefits for treasury and finance leaders, such as efficiency, flexibility, security, reporting & analytics, and scalability. The following benefits have been identified by Kyriba clients as the most outstanding:

- Cost savings: A payment hub reduces the number of systems that need to connect to a bank, thus reducing bank service fees and software costs.

- Central responsibility: With the use of a single system to request, initiate, approve and transmit payments, a single team is responsible for all payments and the risk of mistakes and unauthorized payments is lower.

- Global visibility: By centralizing payments via a payment hub, treasury has complete visibility to all outgoing cash flows in one place, allowing for the optimization of cash balances and enabling more effective decisions on cash and liquidity deployment.

- Eliminated reliance on IT: Since modern payment hubs are usually hosted in the cloud and offered as SaaS platforms, with features such as automated bank format generation and integrated bank connectivity, there is no need for IT to build and maintain bank connections.

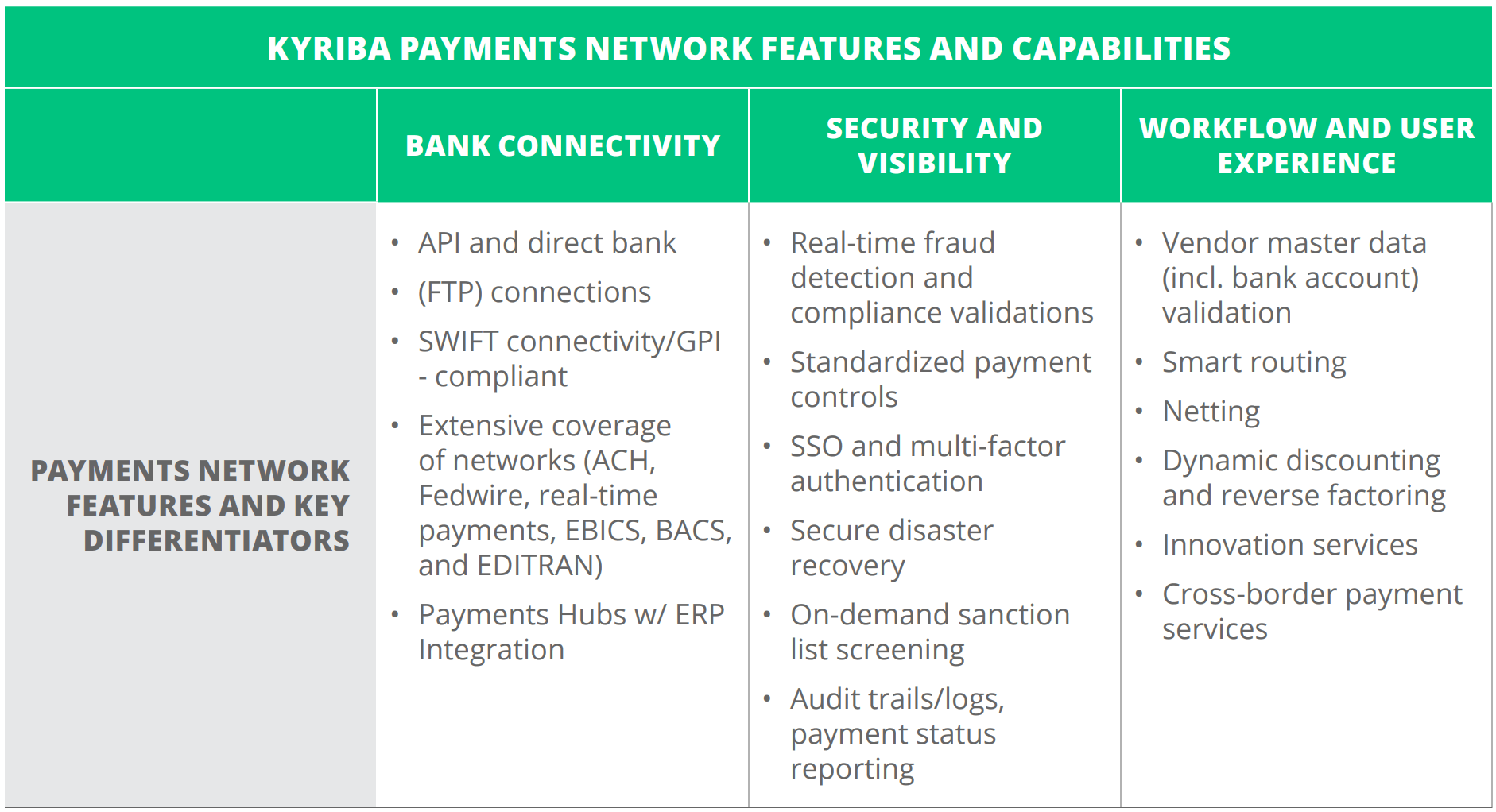

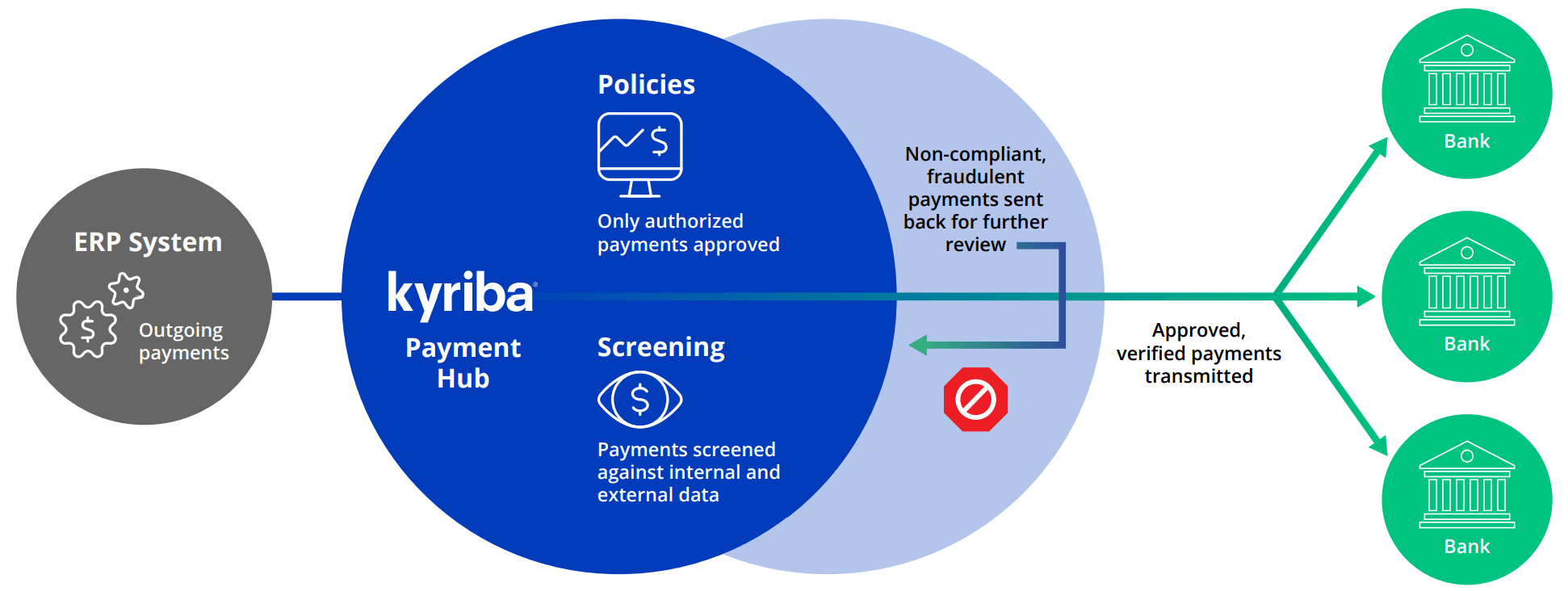

- Fraud detection and compliance: All outgoing payments are screened in real-time against external sanction lists and a digitized payments policy to ensure only authorized payments are transmitted.

Key Features of a Payment Hub

Usually a well-designed, fully implemented corporate payment hub should cover the following main features, with possibility for customization too:

- Standardized workflow and controls: Payment workflow and controls ensure manual payments activities align to the organization’s payment policy and standardized payment controls.

- Payment screening and fraud protection: Real-time screening of payments and fraud detections act as a line of defense against unauthorized payments.

- Global bank connectivity: By integrating with banks across the globe, payment hubs deliver out of the box, host-to-host and regional network bank interfaces.

- Pre-built format libraries: Payment hubs are able to meet the needs of various global banks and can accommodate thousands of format variations.

- Two-way communication: Receipt of payments acknowledgements, payments tracking and bank status reporting are communicated to all parties for status reporting and visibility.

- Data visualization and analytics: with bi-enabled data visualizations, finance and treasury can gain in-depth insight into global payments and have access to enhanced analytics.

Difference Between a Payment Hub and an In-House Bank

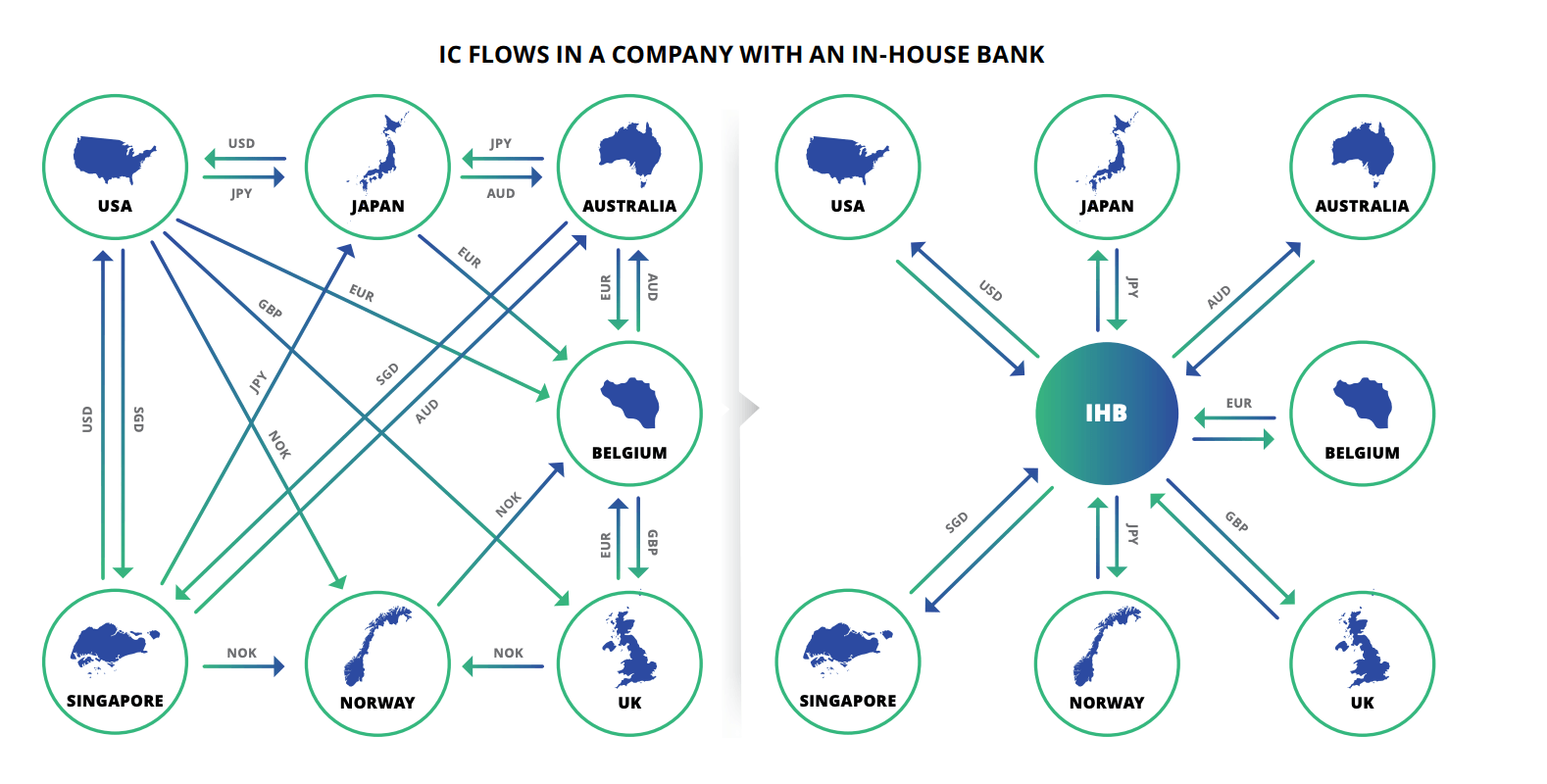

An in-house bank (commonly referred to as IHB) is a dedicated group or legal entity within the organization that provides banking services such as cash management, payments-on-behalf-of (POBO), and collections-onbehalf-of (COBO) to different business units within the company. In simple terms, an IHB centralizes payment flows and balances by executing all transactions through one designated entity.

While IHBs and payment hubs are both financial systems that can help organizations manage their payments and cash flow more efficiently by centralizing activities, they serve different purposes.

An IHB is an internal unit that consolidates banking information and cash activities to give the company centralized control and visibility and help streamline cash management and reduce costs, as well as improve financial reporting. And a payments hub can actually be introduced as part of an IHB implementation.

Global companies often find themselves in the situation that different entities or departments make payments to the same third-party vendor(s) through their own local banks, which creates a great opportunity for consolidation to save costs and lower complexity. The introduction of an IHB allows organizations to utilize a payments-on-behalf-of (POBO) model to consolidate and streamline payments that are being made to the same vendor, and a payment hub is a great tool to support such initiative, because it provides the needed workflow design and automation to facilitate a quicker implementation of an in-house banking structure.

How to Select the Right Payment Hub Solution

The decision to select a payment hub provider must be made not only to meet present-day requirements but also have the scalability to support future needs: What is the growth plan for your organization in the next 3-5 years? Is there any upcoming divest or M&A? Does your company plan to expand into new geographic territories? How many new banks might be added to your payments landscape? All these questions are good to ask when you select a payment hub.

The following best practices are useful when selecting a payment hub provider for your current and future payment needs:

- Functionality: A payment hub should provide all the basic and advanced functionality to meet the current and future payment needs of an enterprise with a global banking footprint. Knowing your organization’s growth plan is important. Understanding your vendor’s roadmap is equally important so that you can map your needs to the capabilities of your vendor.

- A pre-built formats library: Dedicated bank payment format development is a key differentiator to separate a basic payment hub from a sophisticated one. Therefore it is important that you ask your vendor who will take care of all the future format development and maintenance after the payment hub is implemented, especially when you do not have the resources at your disposal for this task.

- Security: Security is the backbone of any payments operations. A vendor’s security ops are most often invisible to a buyer but there are still things that you can validate. This includes ISO 27001 certification, SOC1/SOC2 compliance, SWIFT compliance, disaster recovery, cyber security operations, cloud security, just to name a few. Kyriba handles its security operations to the highest industry standards.

- Alignment: Geographic alignment with your payments program is key. If your payment banks exist in North America, Europe, Asia or Latin America, then so too should the implementation and product support of your payment hub vendor.

How to Implement a Payment Hub

Implementing a payment platform can be a complex process, that is why it is important to follow some best practices throughout the process.

- Define your requirements: Take an inventory of the types of payments you need to process, the main and secondary banks your payments are being executed, the amount of bank accounts you need to manage, and more importantly, the possible future payment needs that you might need to support, for example, real-time payments and ISO 20022 XML format migration.

- Choose a payment hub solution: Once you have defined the requirements, you can start to evaluate the different solutions and initiate an RFP to gather information. As listed above, it is important to find a solution that can meet your business needs both today and tomorrow.

- Integrate with existing systems: A payment hub is to be connected to your ERP, Account Payables or Payroll systems where payments requests will be initiated. This may involve a lot of custom development because system interfaces can vary. It is recommended to consider using connectivity-as-a-service to speed up this process.

- Integrate with banks: Depending on how many banks you need to connect, this can take time and it’s important to thoroughly test the bank connections to ensure payments will be sent through different channels correctly. Many Kyriba clients choose to start in selected regions or banks before global roll-out.

- Deploy and optimize: This may involve tweaking or updating payment policies and approval rules, adding new payment types or channels, or optimzing the number of banks and bank accounts.

In summary, implementing a payments hub requires a comprehensive understanding of your own corporate payments scope and needs and extensive expertise in system and bank integration. Working with experienced payment technology partners can speed up the implementation and minimize unforeseeable risk events.

How to Manage Payment Approval Workflows with a Payment Hub

A payment hub facilitates the establishment of a standardized payment approval process and offers many features to streamline the process. Companies can follow their existing workflows and implement those or use the opportunity to follow some industry best practices to renew the approval workflows in order to enhance payments security.

The following depicts a typical payment approval workflow management process:

- Define Payment Approval Policies: The first step is always to establish payment approval policies and procedures that are consistent with your company policies, such as payment limits, approval authority, signature rights and how to handle exceptions, urgent payments or escalations.

- Configure Payment Approval Workflows: Use the payment hub to set up the designed payment approval workflows. Make sure that all the defined policies are implemented in the payment hub and tested too.

- Assign Approval Roles and Permissions: Set up individuals or groups according to the defined responsibilities and approval authority.

- Activate Automated Alerts: Leverage the payment hub automated alerts features to ensure timely process of any payments approvals, exceptions, rejections or emergencies. This can include setting up automated approval rules and alerts for pending approvals or payments that require extra attention.

- Monitor and Audit: Regularly monitor and audit your payment approval workflows to ensure compliance with policies and identify any changes or potential risks. For example, one best practice is to organize regular audits of the signees and their approval authority to minimize internal fraud risks.

- Allocate resources for training: Ensure that all team members who are involved in the payment approval process are given enough trainings on the policies, procedures, and systems used, in order to avoid unnecessary human errors.

All in all, managing payment approval workflows with a payment hub can greatly enhance compliance with policies and regulations, reduce payment errors and fraud risks, and improve cost and productivity efficiency.

ROI of Using a Payment Hub Solution

A payment hub solution can generate tremendous tangible return on investment (ROI). Kyriba client Oracle Cerner saved 930 IT hours per year, including 410 hours of SWIFT AL2 maintenance and 520 hours of bank connectivity maintenance by migrating to Kyriba SWIFT Service Bureau with the following features:

- Faster bank connectivity through Open APIs

- A Payment Hub to consolidate and create a consistent and automated file and payment instruction pathway

- ERP integration for reporting to and from related systems

- SWIFT BIC automation facilitates bank communication via SWIFT Service Bureau

Another good example is from Kyriba’s client Adobe. As an organization which has 125 global users manually logging into 10+ banking portals on a daily basis to process payments and statements, the use of Kyriba’s payment hub solution has led to a centralized repository of 24 signers tracked and eight bank letter templates maintained with four banks connected for bank fee statement reporting and proactive fee management.

Examples of Payments Hub Software

Some examples of payment hub software include ERP systems with integrated payment modules, standalone payment gateway solutions, and specialized payment management software that consolidates various payment systems into a single platform.

Kyriba offers a pre-connected, multi-bank and secure global payments network for organizations of all sizes. The payment solution centralizes and standardizes company-wide payments workflows to enhance both controls and efficiencies with task automation, error management, fraud detection and full status visibility, all integrated in one payments hub.